Tokenomics

Welcome to Dexifund's Tokenomics & Ecosystem Technical Documentation

Introduction

- Token Overview

- Token Utility

- Tokenomic Model

- Token Allocation

- Associated Links

Macro Tokenomics (Advanced)

Year 1 Summary

- Token Allocation & Summary

- Supply Distribution Chart

- Buy & Sell Tax Utilisation

- Tokenomic KPI's

Year 2 Summary

- Token Allocation & Summary

- Supply Distribution Chart

- Buy & Sell Tax Utilisation

- Tokenomic KPI's

Year 3 Summary

- Token Allocation & Summary

- Supply Distribution Chart

- Buy & Sell Tax Utilisation

- Tokenomic KPI's

Year 4 Summary

- Token Allocation & Summary

- Supply Distribution Chart

- Buy & Sell Tax Utilisation

- Tokenomic KPI's

Establishment of the DAO

$DEXI Flywheels

Core Mechanisms

- $DEXI Buyback & Burns

- Theoretical Impact (Bull)

- Theoretical Impact (Bear)

- Buy & Sell Taxes

- Tokenomic KPI's

Total (AUM) Fees

Revenue Streams

Transparency in Reporting

Increasing Investor & Token Holder Value

Investor Relations

Dexifund Def-AI Project Incubator Plan

Liquidity Management

Frequently Asked Questions

$DEXI Token Roadmap

1. Introduction

- What is Dexifund?

- Provide a high-level overview of the project.

- Explain the purpose of the token ($DEXI) and its role in the ecosystem.

- Mission and Vision:

- Highlight the project’s long-term goals and value to investors and users.

2. Token Overview

- Token Name and Symbol:

- Example: Dexifund Token ($DEXI).

- Blockchain and Standards:

- Indicate whether the token is on Ethereum (ERC-20) or another blockchain.

- Total Supply:

- State the maximum supply (e.g., 1 billion tokens) and whether it’s capped.

- Token Name and Symbol:

4. Token Utility

- Core Functions of $DEXI:

- Governance: Voting rights in Dexifund proposals.

- Staking: Earn rewards through staking.

- Buybacks and Burns: Deflationary mechanics to increase scarcity.

- Rewards: Distribution of revenue shares or dividends to holders.

- Use Cases:

- Highlight real-world applications for the token (e.g., funding AI projects, supporting incubators, governance).

5. Economic Model

- Buy Tax and Sell Tax:

- Example:

- Buy Tax: 1%, allocated to liquidity pools (75%) and buybacks (25%).

- Sell Tax: 1%, allocated to treasury (75%) and buybacks (25%).

- Example:

- Buyback-and-Burn Mechanism:

- Explain how taxes fund token buybacks and how burns reduce supply.

- Include formulas or simulations.

- Revenue Model:

- Detail how funds from taxes or investments generate revenue for Dexifund.

- Include graphs or projections to show ROI to investors.

3. Token Allocation

- Distribution Breakdown:

- Use a chart or table to show token allocation categories, e.g.:

- Preseed ICO>? 10%

- Public Sale: 50%.

- Treasury & Operations: 15%.

- Team Unlocks: 15%.

- Def-AI Project Incubator: 10%.

- Include a graphic pie chart for visualization.

- Use a chart or table to show token allocation categories, e.g.:

- Unlock Schedule:

- Explain how and when tokens will unlock for different categories (e.g., over five years).

- Provide a timeline chart or linear unlock graph.

iNCLUDE VIDEO OF OVERVIEW OF TOKENOMICS

Macro (Token) Nomics (Advanced)

Year 1 – Token Allocation & Summary

Primary Goals: Liquidity + Capital

Total Supply: 1,000,000,000 (1 Billion) $DEXI

ICO/Pre-Sale

Initial Public Offering / TGE: 600,000,000 (600 Million) $DEXI

Treasury & Operations Unlocks: 15,000,000 (15 Million) $DEXI

Team Unlocks: 15,000,000 (15 Million) $DEXI

Dexifund Def-AI Project Incubator: 10,000,000 (10 Million) $DEXI

Total Circulating Supply EOY1: 600,000,000 + ICO / Presale + Treasury & Operations Unlocks + Team Unlocks + Dexifund DeF-AI Project Incubator = 640,000,000 (640 Million) $DEXI – Dexifund Tokens Buyback & Burned (ZK- Smart Contract)

Example: 640,000,000 Total Circulating Supply $DEXI EOY1 – 60,000,000 Dexifund Tokens Buyback & Burn = 580,000,000 Actual Circulating Supply EOY1

⊕Year 1: Buy Tax 1% –> 75% Dexifund’s Liquidity Reserve Pools + 25% Dexifund Tokens Buyback & Burned Mechanism (minus Gas Fees)

⊗Year 1: Sell Tax 1% –> 75% Dexifund’s Treasury + 25% Dexifund Tokens Buyback & Burned Mechanism (minus Gas Fees)

Token Supply Distribution Chart (Year 1)

*Chart does not illustrate any of the planned $DEXI Token Buyback & Burns, which effectively make Total Circulating Supply EOY1 significantly <640,000,000 $DEXI

Buy & Sell Tax Utilisation

- ≈75%⊕Dexifund’s Liquidity Reserve Pools: Ensures high liquidity reserves for token trading, reducing slippage %, improving stability, increases volume quotient, enables greater liquidity across multiple DEX platforms and encouraging investor confidence.

- ≈75% ⊗ DexiFund’s Treasury: Enables the treasury to rapidly mobilise funds for active trading and reinvesting into DeFi, DeFAI, Stable coins and increase total portfolio value through purchasing tokens, yield farming strategies or other mechanisms.

- ≈50% ⊕⊗ $DEXI Token Buyback & Burns: Provides immediate deflationary mechanisms at launch to the $DEXI token, helps further offset sells through recurrent daily buys (See Core Mechanisms for further details <HERE>)

Year 1 Tokenomic KPI’s

- Build liquidity reserves quickly for seamless trading on decentralized exchanges (DEXs).

- Generate and mobilise capital rapidly for the fund to invest in its DeFi ETF portfolio, and active trading funds.

- Stabilize token price and improve potential investor growth outlook through increased trading volume and liquidity.

- Mitigate excessive short-term speculative volatility

Year 2

Goals: Growth & Deflation

Total Supply: 1,000,000,000 (1 Billion) $DEXI

Year 2 Start Circulating Supply: 640,000,000 (640 Million) $DEXI – (Buyback & Burned Tokens Year 1)

Treasury & Operations Unlocks: 15,000,000 (15 Million) $DEXI

Team Unlocks: 15,000,000 (15 Million) $DEXI

Dexifund Def-AI Project Incubator: 10,000,000 (10 Million) $DEXI

Total Circulating Supply EOY2: 640,000,000 + Treasury & Operations Unlocks + Team Unlocks + Dexifund DeF-AI Project Incubator = 680,000,000 (680 Million) $DEXI – Dexifund Tokens Buyback & Burn (ZK- Smart Contract)

Example: 680,000,000 Total Circulating Supply $DEXI EOY2 – (60,000,000 + 40,000,000) Dexifund Tokens Buyback & Burn Years 1+2 = 580,000,000 Actual Circulating Supply EOY2

⊕Year 2 Buy Tax 1% –> 50% Dexifund’s Liquidity Reserve Pools + 50% Dexifund Tokens Buyback & Burn (Incl. Gas Fees)

⊗Year 2 Sell Tax 1% –> 75% Dexifunds Treasury + 25% Dexifund Tokens Buyback & Burn (Incl. Gas Fees)

Token Supply Distribution Chart (Year 2)

*Chart does not illustrate any of the planned $DEXI Token Buyback & Burns, which effectively make Total Circulating Supply EOY2 significantly <680,000,000 $DEXI

Buy & Sell Tax Utilisation

- ⇓ 50% ⊕ Dexifund’s Liquidity Reserve Pools: Maintains sufficient liquidity reserves for token trading, reducing slippage %, improving stability, increases volume quotient, enables greater liquidity across multiple DEX platforms and encouraging investor confidence.

- ≈75% ⊗ DexiFund’s Treasury: Facilitates continued capital generation for active trading and reinvesting into DeFi, DeFAI, Stable coins and increase total portfolio value through purchasing tokens, yield farming strategies or other mechanisms.

- ⇑75% ⊗ ⊕ $DEXI Token Buyback & Burns: Accelerates deflationary mechanisms at launch to the $DEXI token, helps further offset sells through recurrent daily buys (See Core Mechanisms for further details <HERE>)

Year 2 Tokenomic KPI’s

- Sustain high liquidity reserves for seamless trading on decentralized exchanges (DEXs).

- Generate capital for the fund to invest in its DeFi ETF portfolio, and active trading funds

- Stabilize token price and improve potential investor growth outlook through increased trading volume and liquidity.

- Rapidly increase the token into a deflationary model to facilitate supply shock on price as the supply decreases.

- Reward long-term investors through increased perceived token value over time.

Year 3

Goals: Economies of Scale

Total Supply: 1,000,000,000 (1 Billion) $DEXI

Year 3 Start Circulating Supply: 680,000,000 (680 Million) $DEXI – (Buyback & Burned Tokens Year 1+2)

Treasury & Operations Unlocks: 15,000,000 (15 Million) $DEXI

Team Unlocks: 15,000,000 (15 Million) $DEXI

Dexifund Def-AI Project Incubator: 10,000,000 (10 Million) $DEXI

Total Circulating Supply EOY3: 680,000,000 + Treasury & Operations Unlocks + Team Unlocks + Dexifund Def-AI Project Incubator = 720,000,000 (720 Million) $DEXI – Dexifund Tokens Buyback & Burn (ZK- Smart Contract)

⊕Year 3 Buy Tax 1% –> 25% Dexifund’s Liquidity Reserve Pools + 75% Dexifund Tokens Buyback & Burn (Incl. Gas Fees)

⊗Year 3 Sell Tax 1% –> 50% Dexifund’s Treasury + 50% Dexifund Tokens Buyback & Burn (Incl. Gas Fees)

Token Supply Distribution Chart (Year 3)

*Chart does not illustrate any planned $DEXI Token Buyback & Burns, which will effectively make Total Circulating Supply EOY3 significantly <720,000,000 $DEXI

Buy & Sell Tax Utilisation

- ⇓ 25% ⊕ Dexifund’s Liquidity Reserve Pools: Maintains sufficient liquidity reserves for token trading, reducing slippage %, improving stability, increases volume quotient, enables greater liquidity across multiple DEX platforms and encouraging investor confidence.

- ⇓ 50% ⊗ DexiFund’s Treasury: Facilitates continued capital generation for active trading and reinvesting into DeFi, DeFAI, Stable coins and increase total portfolio value through purchasing tokens, yield farming strategies or other mechanisms.

- ⇑125% ⊗ ⊕ $DEXI Token Buyback & Burns: Accelerates deflationary mechanisms at launch to the $DEXI token, helps further offset sells through recurrent daily buys (See Core Mechanisms for further details <HERE>)

Year 3 Tokenomic KPI’s

- Transition the token into a deflationary model to create upward pressure on price as the supply decreases.

- Reward long-term investors by boosting the token’s value over time.

Year 3 Tokenomic KPI’s

- Build liquidity reserves for seamless trading on decentralized exchanges (DEXs).

- Generate capital for the fund to invest in its DeFi ETF portfolio, which drives the token’s value.

- Stabilize token price through increased trading volume and liquidity.

Year 4

Utility + Sustainability

Total Supply: 1,000,000,000 (1 Billion) $DEXI

Year 4 Start Circulating Supply: 720,000,000 (720 Million) $DEXI – (Buyback & Burned Tokens Year 1+2+3)

Treasury & Operations Unlocks: 15,000,000 (15 Million) $DEXI

Team Unlocks: 15,000,000 (15 Million) $DEXI

Dexifund Def-AI Project Incubator: 10,000,000 (10 Million) $DEXI

Total Circulating Supply EOY3: 720,000,000 + Treasury & Operations Unlocks + Team Unlocks + Dexifund Def-AI Project Incubator = 760,000,000 (760 Million) $DEXI – Dexifund Tokens Buyback & Burn (ZK- Smart Contract)

⊕Year 4 Buy Tax 1% –> 10% Dexifunds Liquidity Reserve Pools + 40% Buy and Burn + 50% Tax Distribution to Stakers

⊗Year 4 Sell Tax 1% –> 50% Dexifunds Treasury + 75% Dexifund Tokens Buyback & Burn (Incl. Gas Fees) $DEXI + 25% Tax Distribution to Stakers

Token Supply Distribution Chart (Year 4)

*Chart does not illustrate any planned $DEXI Token Buyback & Burns, which will effectively make Total Circulating Supply EOY4 significantly <760,000,000 $DEXI

Buy & Sell Tax Utilisation

- ⇓ 10% ⊕ Dexifund’s Liquidity Reserve Pools: Maintains sufficient liquidity reserves for token trading, reducing slippage %, improving stability, increases volume quotient, enables greater liquidity across multiple DEX platforms and encouraging investor confidence.

- ≈ 50% ⊗ DexiFund’s Treasury: Facilitates continued capital generation for active trading and reinvesting into DeFi, DeFAI, Stable coins and increase total portfolio value through purchasing tokens, yield farming strategies or other mechanisms.

- ⇓65% ⊗ ⊕ $DEXI Token Buyback & Burns: Accelerates deflationary mechanisms at launch to the $DEXI token, helps further offset sells through recurrent daily buys (See Core Mechanisms for further details <HERE>)

- ⇑75% ⊗ ⊕ Tax Distribution to Stakers: Incentivises Buying and holding $DEXI tokens movement from deflationary model to XXXXXX

Year 4 Tokenomic KPI’s

- Transition the token into a deflationary model to create upward pressure on price as the supply decreases.

- Reward long-term investors by boosting the token’s value over time.

- Build liquidity reserves for seamless trading on decentralized exchanges (DEXs).

- Generate capital for the fund to invest in its DeFi ETF portfolio, which drives the token’s value.

- Stabilize token price through increased trading volume and liquidity.

Year 5

Same as Year 4 – in terms of tokenomics but a key detail here is tyhe establishment of the DAO

Establishment of the DAO

Staking as a Governance Tool (Optional)

- You can give stakers the right to propose or vote on key decisions—like new incubator investments or treasury allocations.

- Effect: Encouraging stakers to participate in governance can result in more decentralized decision-making and a sense of community ownership.

Powering Dexifund’s Flywheels & Token Ecosystems

A “flywheel” is a self-reinforcing feedback loop, originally referring to a heavy revolving wheel in a machine that builds momentum over time. In a business or tokenomics context, each positive outcome makes the entire system spin faster—generating more energy, fueling more growth, and creating a virtuous cycle that benefits everyone involved. (insert reference on a flywheel, in an economic context)

How the Flywheel Effect Powers The $DEXI Ecosystem

1. Buying & Selling Facilitates Treasury Growth

- Action: Every transaction of $DEXI—whether a buy or a sell—contributes a small tax to Dexifund’s treasury.

- Mechanism: Buy Tax and Sell Tax are collected in seperate tokens, and in segregated independent smart contracts

- Result: The treasury (a.k.a. war chest) grows automatically from trading activity, providing more capital for investments, yield-farming strategies, and future buybacks.

2. Treasury Funded $DEXI Token Buybacks & Burns

- Action: As the treasury grows over time, and economies of scale enable funds to become available to conduct buybacks.

- Mechanism: Each buyback removes tokens from circulation (“burn”), reducing supply and creating deflationary pressure (Greatly accelerated in Years 1, 2, 3)

- Result: Buybacks & Burns reduce circulating supply and comparatively total supply which causes buy pressure, increases scarcity of tokens, has potential to raise $DEXI token perceived valu, and creates a favorable opportunity to market the action within the community

3. Greater Trading Volume -> Greater Trading Growth

- Action: As greater adoption occurs amongst traders, investors and speculators facilitated by rising growth of the token and investor confidence which increases trading volume, so to does treasury trading growth. DEXIFUND’s establishment as a growth focused project

- Mechanism: With each transaction taxed, the treasury grows further, creating a positive feedback loop.

- Result: The cycle accelerates rapidly to fuel rapid growth of the treausry trading funds, snowballing and in anticipation of favourable trading conditions

4. Snowballing of Fund Performance

- Action: A robust treasury allows Dexifund to invest in yield-generating DeFi strategies and emerging blockchain projects.

- Mechanism: As fund performance improves, the ecosystem’s perceived value grows—benefiting $DEXI holders, spurring even more interest and participation.

- Result: the success of the fund elevates the token’s intrinsic and perceived value, adding another layer of upward momentum in the flywheel.

5. Staking & Rewards

- Action: Introduction of native $DEXI token staking in Year 4 helps to reduce circulating supply, increasing scarcity additionally aids in offsetting any token unlocks, (in fact slightly inflationary token supply as what is proposed in chart below actually favourable for liquidity for staking

- Mechanism:If stakers earn a share of the fund’s yield, it provides a tangible incentive to lock up tokens longer, further reducing supply on the open market.

- Result:This can then lead to more stable token prices, which encourage new participants, further volume, and a reinforced core flywheel.

6. Token Appreciation Reinforces Investor Confidence

- Action: Greater Adoption, Later Stages of Buybacks & Burns, Profitable Active Trading, Increased AUM of the Dexifund Treasury, Rewards to Staking, Revenue Sharing, Yield Rewarding Strategies /Dividends, increased mNAV ratio from a pureply tokenomic standpoint along with assumed community, transparency, ledership all help lead to $DEXI token appreciation.

- Mechanism: Long-term appreciation of the token increases confidence and demand, as long-term holders feel more secure, and new investors see an attractive opportunity.

- Result:Higher demand plus reduced supply fuels further appreciation, enticing more market participation and thus more transactions.

As deflation increases, supply decreases, hence token appreciation.

7. Leverage

8 Dexifund AI Incubator Flywheel

Merntion birefly but provide link to the AI incubator page and full breakdown of what that is there

how both buys and sells of $DEXI tokens facilitate rapidly increasing buybacks

Questions

Decayed unlocks? i.emore team unlocks at start followed by decay reducing unlocks amount?

In the buy and burn mechanism, there is potential to burn the liquidity? maybe if there is additional liquidity left over at end of year 4 those tokens are burnt also

The buy + burn mechanism should be done on the OPEN MARKET as a transaction, so that it increases shareholder value

Team token SWAPS – swap $DEXI team tokens for equal value in another token – could lead to less sells of $DEXI and more of a higher MC token

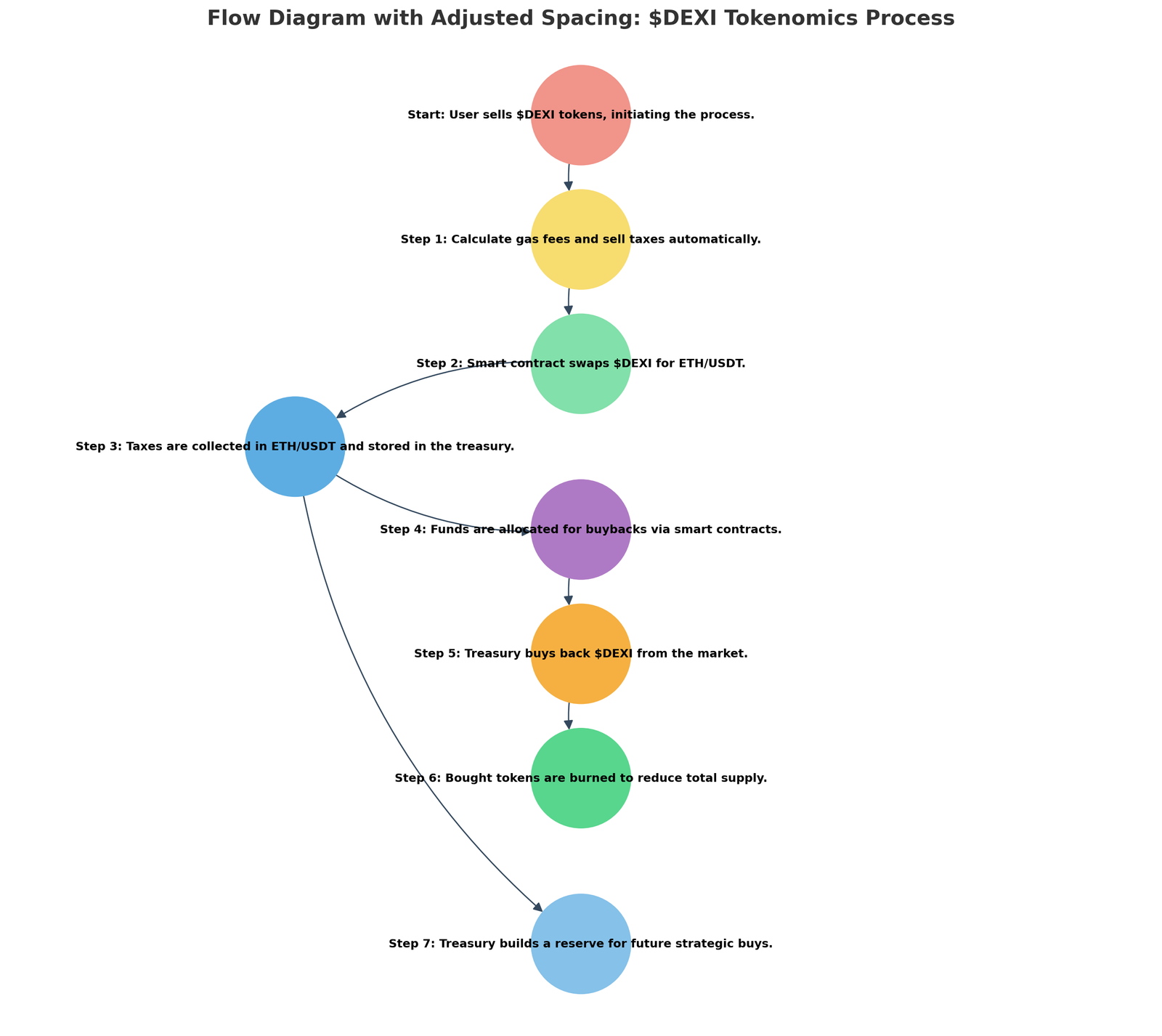

- The smart contract uses the tax revenue to automatically:

- Purchase tokens from the liquidity pool.

- Burn those tokens by sending them to an unrecoverable wallet (e.g., address

0x000...dead). is that actually a thing / good idea to buyback tokens from the LP? and not the open market? question that

Core Mechanisms

1. Mechanism: Dexifund Buyback & Burns

Overview

Dexifund Buyback & Burns are a core strategy of Dexifund, purpose of the is to buyback dexofund tokens on the open market, and send to burn address

In efforts to facilitate long-term holding, growth and stability of $DEXI as a token we have introduced a complex tokenomic structure to enable rapid growth, deployment, and adoption of both our financial instruments and capital while simultaneously directly increasing shareholder value and improving scarcity through buy and burns which act as a deflationary mechanism to reduce total supply.

How $DEXI Token Buybacks & Burns Function

How Buys and Burns work with Dexifund. Buys and Burns are managed daily at X + Random time (Random time 8hrs -48hrs) where X =

Buybacks will be carried out frequently every 1 day +/- 48hrs. Frequent buys means more stability with daily prices, while also avoiding our buys being front run by bots, albeit higher gas fees but is a necessary compromise.

Purpose of Buyback + Burns

- Increase Stability

- Maintain Liquidity (Consistently buying back $DEXI tokens add liquidity to the tokens trading pair (ETH / $DEXI)

- Volume, Volume, Volume (Buy-backs increase volume, like-wise speculation of buy-backs by traders increases token buying/selling activity). High volume can make $DEXI more attractive and visible on DEX token platforms (Buying, Selling, Monitoring, Portfolios etc.)

- Reduces Total Supply –> Increases Scarcity of $DEXI tokens

- Improves mNAV / token

- Enables Dexifund to buy-back tokens during periods of favourable token price

- High Buyback + Burn Rates at initial token launch has the greatest impact and reduces supply, and token appreciation for early investors

- Decaying Buybacks and scaling them down through later years/phases while also introducing Revenue Share Rewards facilitates and retains more circulating supply, ensuring healthy liquidity for trading and staking.

- Adoption of a hybrid model balances scarcity with usability, ensuring token holders see utility, and value in the chain beyond deflation.

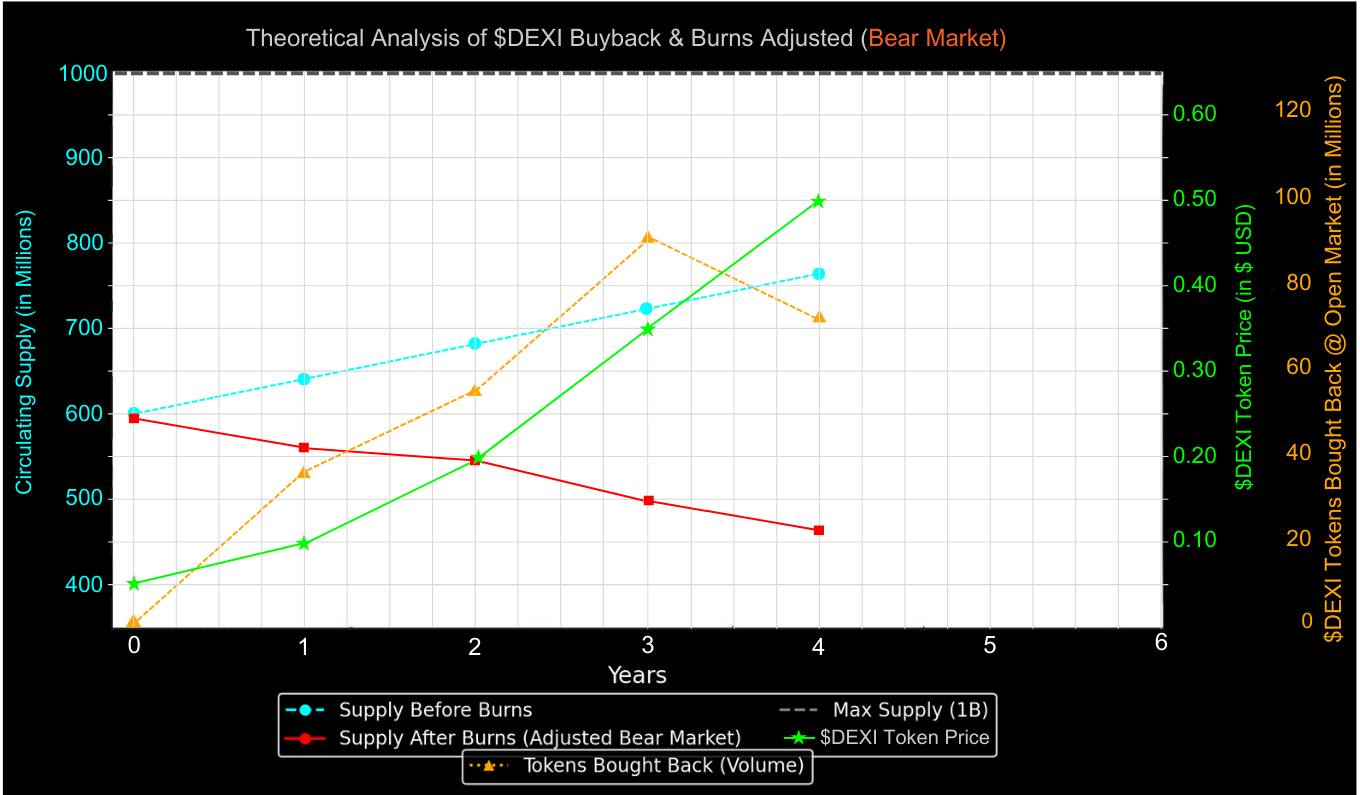

Theoretical Analysis on the Impact of $DEXI Token Buyback & Burns in Unfavourable Market Making Conditions (Bear Market)

Bear Market Scenario: Impact of Buybacks with Unlocks

This table represents the adjusted impact of buybacks under bear market conditions, where trading volumes and token prices are significantly lower. The calculations show how reduced volumes affect buyback funds, tokens bought back, and circulating supply.

Start Year 0

- Daily Trade Volume: $1,000,000

- Buyback Allocation: 0.5%

- Buyback Funds: $1,825,000

- Token Price: $0.05

- Tokens Bought Back: 36,500,000

- Supply After Burns: 563,500,000

- Unlocked Tokens: 40,000,000

- End of Year Circulation Supply: 603,500,000

Buyback Funds = 1,000,000 × 365 × 0.005 = $1,825,000 Tokens Bought Back = $1,825,000 ÷ 0.05 = 36,500,000

Start Year 1

- Daily Trade Volume: $2,000,000

- Buyback Allocation: 0.75%

- Buyback Funds: $5,475,000

- Token Price: $0.10

- Tokens Bought Back: 54,750,000

- Supply After Burns: 548,750,000

- Unlocked Tokens: 40,000,000

- End of Year Circulation Supply: 588,750,000

Buyback Funds = 2,000,000 × 365 × 0.0075 = $5,475,000 Tokens Bought Back = $5,475,000 ÷ 0.10 = 54,750,000

Start Year 2

- Daily Trade Volume: $4,000,000

- Buyback Allocation: 1.25%

- Buyback Funds: $18,250,000

- Token Price: $0.20

- Tokens Bought Back: 91,250,000

- Supply After Burns: 497,500,000

- Unlocked Tokens: 40,000,000

- End of Year Circulation Supply: 537,500,000

Buyback Funds = 4,000,000 × 365 × 0.0125 = $18,250,000 Tokens Bought Back = $18,250,000 ÷ 0.20 = 91,250,000

Start Year 3

- Daily Trade Volume: $6,000,000

- Buyback Allocation: 1.15%

- Buyback Funds: $25,185,000

- Token Price: $0.35

- Tokens Bought Back: 71,957,143

- Supply After Burns: 465,542,857

- Unlocked Tokens: 40,000,000

- End of Year Circulation Supply: 505,542,857

Buyback Funds = 6,000,000 × 365 × 0.0115 = $25,185,000 Tokens Bought Back = $25,185,000 ÷ 0.35 = 71,957,143

Start Year 4

- Daily Trade Volume: $8,000,000

- Buyback Allocation: 1.15%

- Buyback Funds: $33,580,000

- Token Price: $0.50

- Tokens Bought Back: 67,160,000

- Supply After Burns: 438,382,857

- Unlocked Tokens: 40,000,000

- End of Year Circulation Supply: 478,382,857

Buyback Funds = 8,000,000 × 365 × 0.0115 = $33,580,000 Tokens Bought Back = $33,580,000 ÷ 0.50 = 67,160,000

Table Summary

| Year | Year Starting Supply (Minus Burns) | Buyback Allocation (%) | Buyback Funds ($) | Token Price (in USD$) | Tokens Bought Back (in Millions) | Supply After Burns | Unlocked Tokens (Treasury, Team, Ops) | End of Year Circulating Supply (Adjusted) | Circulating Supply (Unadjusted) (in Millions) |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 600000000 | 0.5 | 1825000 | 0.05 | 36500000 | 563500000 | 40000000 | 603500000 | 600000000 |

| 1 | 603500000 | 0.75 | 5475000 | 0.1 | 54750000 | 548750000 | 40000000 | 588750000 | 640000000 |

| 2 | 588750000 | 1.25 | 18250000 | 0.2 | 91250000 | 497500000 | 40000000 | 537500000 | 680000000 |

| 3 | 537500000 | 1.15 | 25185000 | 0.35 | 71957143 | 465542857 | 40000000 | 505542857 | 720000000 |

| 4 | 505542857 | 1.15 | 33580000 | 0.5 | 67160000 | 438382857 | 40000000 | 478382857 | 760000000 |

This table demonstrates how lower trade volumes in a bear market reduce the effectiveness of the buyback and burn mechanism.

The circulating supply remains higher, and the deflationary pressure is less significant compared to favorable market conditions.

*This table is for demonstration purposes only.

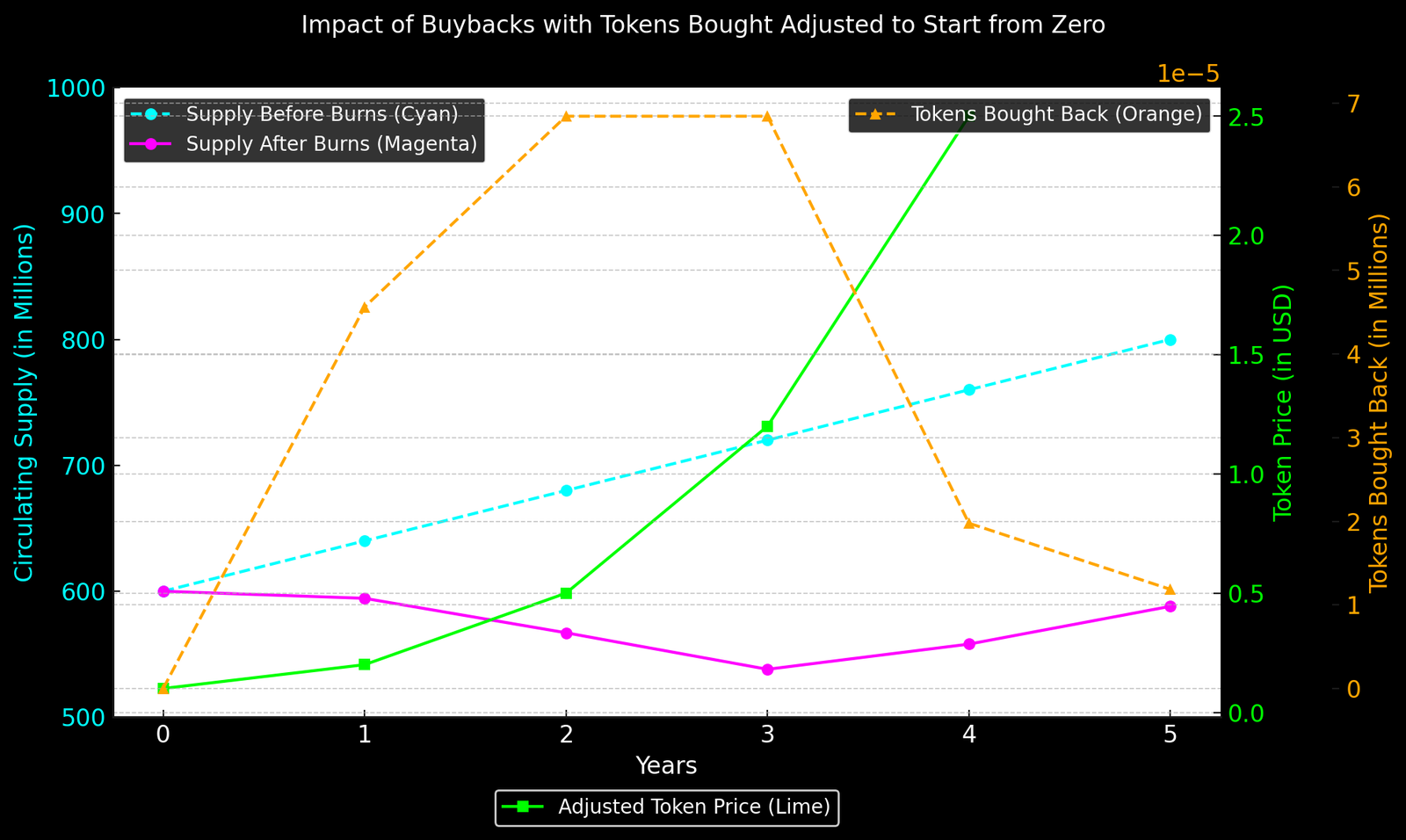

Theoretical Analysis on the Impact of $DEXI Token Buyback & Burns in Favourable Market Making Conditions (Bull Market)

Impact of Buybacks with Unlocks and Tax Allocations

This section explains the mathematics behind the buyback and burns mechanism as represented in the chart. The calculations demonstrate how $DEXI tokens are bought back and burned to reduce circulating supply, increase scarcity, and support price appreciation over time.

Start Year 0

- Daily Trade Volume: $50,000,000.0

- Buyback Allocation: 0.5%

- Buyback Funds: $9,125,000

- Token Price: $0.1

- Tokens Bought Back: 91,250,000

- Supply After Burns: 508,750,000

- Unlocked Tokens: 40,000,000

- End of Year Circulation Supply: 548,750,000

Buyback Funds = 50,000,000.0 × 365 × 0.5% = $9,125,000 Tokens Bought Back = $9,125,000 ÷ $0.1 = 91,250,000

Start Year 1

- Daily Trade Volume: $80,000,000.0

- Buyback Allocation: 0.75%

- Buyback Funds: $21,900,000

- Token Price: $0.33

- Tokens Bought Back: 66,363,636

- Supply After Burns: 482,386,364

- Unlocked Tokens: 40,000,000

- End of Year Circulation Supply: 522,386,364

Buyback Funds = 80,000,000.0 × 365 × 0.75% = $21,900,000 Tokens Bought Back = $21,900,000 ÷ $0.33 = 66,363,636

Start Year 2

- Daily Trade Volume: $10,000,000.0

- Buyback Allocation: 1.25%

- Buyback Funds: $45,625,000

- Token Price: $0.75

- Tokens Bought Back: 60,833,333

- Supply After Burns: 461,553,031

- Unlocked Tokens: 40,000,000

- End of Year Circulation Supply: 501,553,031

Buyback Funds = 10,000,000.0 × 365 × 1.25% = $45,625,000 Tokens Bought Back = $45,625,000 ÷ $0.75 = 60,833,333

Start Year 3

- Daily Trade Volume: $12,000,000.0

- Buyback Allocation: 1.15%

- Buyback Funds: $50,370,000

- Token Price: $1.2

- Tokens Bought Back: 41,975,000

- Supply After Burns: 459,578,031

- Unlocked Tokens: 40,000,000

- End of Year Circulation Supply: 499,578,031

Buyback Funds = 12,000,000.0 × 365 × 1.15% = $50,370,000 Tokens Bought Back = $50,370,000 ÷ $1.2 = 41,975,000

Start Year 4

- Daily Trade Volume: $16,000,000.0

- Buyback Allocation: 1.15%

- Buyback Funds: $67,160,000

- Token Price: $2.3

- Tokens Bought Back: 29,200,000

- Supply After Burns: 470,378,031

- Unlocked Tokens: 40,000,000

- End of Year Circulation Supply: 510,378,031

Buyback Funds = 16,000,000.0 × 365 × 1.15% = $67,160,000 Tokens Bought Back = $67,160,000 ÷ $2.3 = 29,200,000

| Year | Starting Supply (Minus Burns) | Buyback Allocation (%) | Buyback Funds ($) | Token Price (USD) | Tokens Bought Back (Millions) | Supply After Burns | Unlocked Tokens | Adjusted Circulating Supply | Unadjusted Circulating Supply (Millions) | Daily Trade Volume |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.0 | 600000000.0 | 0.5 | 9125000.0 | 0.1 | 91250000.0 | 508750000.0 | 40000000.0 | 548750000.0 | 600000000.0 | 50000000.0 |

| 1.0 | 548750000.0 | 0.75 | 21900000.0 | 0.33 | 66363636.0 | 482386364.0 | 40000000.0 | 522386364.0 | 640000000.0 | 80000000.0 |

| 2.0 | 522386364.0 | 1.25 | 45625000.0 | 0.75 | 60833333.0 | 461553031.0 | 40000000.0 | 501553031.0 | 680000000.0 | 10000000.0 |

| 3.0 | 501553031.0 | 1.15 | 50370000.0 | 1.2 | 41975000.0 | 459578031.0 | 40000000.0 | 499578031.0 | 720000000.0 | 12000000.0 |

| 4.0 | 499578031.0 | 1.15 | 67160000.0 | 2.3 | 29200000.0 | 470378031.0 | 40000000.0 | 510378031.0 | 760000000.0 | 16000000.0 |

Assumptions:

- Price does not increase past x an=mount based on previous bear markets inser reference

- Year 4-5 Established DAO governance,

- Market cap at Year 1, Year 2, Year 3 =

In both simulated bare and bull market scenario taxi fund is deflationary up until year three at which point revenue share and liquidity increases which incentivizes people to stake and lower the circulating supply

2. Mechanism: Standardised Buy & Sell Taxes

Overview

How taxes are managed, calculated, and efficiently handled.

Every transaction on the blockchain incurs the following: Cost of token @ market value + Gas Fees + Tax Fees

How Dexifund manages and utilises taxes on chain at point of transaction and facilitates price discovery and deflation of $DEXI token.

Person A sells 1,000 $DEXI tokens at a price of $1 or 0.0004 ETH / token = $1,000 or 0.4 ETH – (Cost of Gas Fees Eth + Sell Tax) (Verify it works like this)

Our smart contract flow works as follows: Select $DEXI –> Select Swap Pair –> Calculate Gas Fees, Calculate Sell Taxes –> CONFIRM –> EXECUTE –> Smart Contract Sell $DEXI –> Select Swap Pair ETH –> CONFIRM –> EXECUTE –> Add to Buyback Smart Contract –> Buy $DEXI –> Transfer to DEAD wallet (Burned).

Why this works. When a quantity of tokens is sold the sell tax is executed, and swapped at point of transaction. What this means is Dexifund treasury can directly receive ETH or USDT tokens. The benefit of this is that when tokens are sold, the taxes are collected with native tokens, which enables buybacks to be truly deflationary in nature and will be frequiently carried out

How Taxes are collected through Buys. Unlike Sells, taxes collected through Buys of $DEXI are granted natively as $DEXI tokens, to

| Income Stream | Allocation Purpose | Key Impact |

|---|---|---|

| Management Fee (3.5%) | Operations, salaries, marketing | Ensures day-to-day fund sustainability |

| Buy/Sell Tax (1%) | 70% reinvested, 30% operational | Portfolio growth + operational buffer |

| Token Launch | Bootstrap operations, reserves | Initial growth capital |

Performance Fee As part of team unlocks (Optional) | Incentivize team performance | Attract top-tier traders/managers |

| Staking/Yield | Reinvest into the portfolio | Passive growth for the fund |

Total Assets Under Management (AUM) Fees

As part of Dexifunds operational and financial structure. The fund as a seperate entity is charged as a deductible a 3.5% Annual Management Fee. Management fees are typically calculated as a percentage of the total assets under management (AUM). Investors in DEXIFUND are not charged this amount directly. Rather the fee is taken directly from the fund’s current Assets Under Management Balance, each month. The 3.5% represents a total annual figure. As the funds portfolio is dynamic, with up to several thousand trades completed each month, Total Assets Value Under Management can vary greatly MoM. As such, in efforts to smooth cash flow, and to ensure fees reflect fluctuations fairly in AUM DEXIFUND’s management fee will be charged monthly at the rate of 0.2916% which equals to a total of 3.5% Total fees charged annually. Please see our Financial Operations Transparency Budget for a full breakdown and rationale on how these fees are utilised each month.

Justification for the Management Fee

The fee should cover the operational costs of managing the fund while providing a reasonable profit for the company. Here’s a breakdown of justifications:

a) Operational Costs

- Portfolio Management:

- Research and analysis for asset selection and rebalancing.

- Active monitoring of DeFi protocols for security and performance.

- Infrastructure Costs:

- Running smart contracts and maintaining the fund’s infrastructure (e.g., gas fees on Ethereum, server costs).

- Liquidity Management:

- Providing and managing liquidity on DEXs (e.g., Uniswap).

- Custody and Security:

- Safeguarding crypto assets in secure wallets (e.g., multisig wallets or custodial services).

- Regular audits to ensure smart contract and wallet security.

b) Investor Services

- Reporting and Transparency:

- Providing regular performance updates and analytics to investors.

- Customer Support:

- Answering investor questions and resolving issues.

- Compliance:

- Meeting regulatory requirements (e.g., FATCA for US investors).

c) Business Growth

- Marketing and Outreach:

- Attracting more investors to grow the fund.

- Team Expansion:

- Hiring skilled personnel for operations, analysis, and support.

d) Risk Justification

- Actively managing a DeFi fund involves significantly higher risks than traditional ETFs (e.g., smart contract vulnerabilities, market volatility). The fee compensates for the complexity and expertise required

a) Core Revenue Streams

Management Fee (Primary):

- Charged annually (or monthly), providing consistent income to cover operational costs.

- Fair Rate: 2-3% annually to remain competitive yet sustainable.

Token Launch:

- Initial Funding: Use part of the proceeds from the token sale to bootstrap operations and infrastructure development.

- Reserve Tokens: Hold a percentage of tokens (e.g., 10-20%) in the treasury to fund future operations, staking rewards, or protocol improvements.

1% Buy-and-Sell Tax:

- Primary Use: Reinvested into the portfolio for long-term growth.

- Secondary Use: Allocate a small portion (e.g., 20-30%) for operational reserves, depending on fund needs.

Staking Rewards:

- If the fund invests in staking assets (e.g., ETH, DOT, ADA), rewards can be used as an additional income source.

- This allows the portfolio to grow while earning yield.

Yield Farming:

- Allocate a portion of the portfolio to yield-generating strategies (e.g., liquidity provision, DeFi lending).

- Earnings can be used for both reinvestment and operational costs.

Dexifunds Income Streams

Transparency in Reporting

Tokenomics Flow Chart

Tokenomic Roadmap

Tokenomic Roadmap discussing ourely tokenomic functions as a section TR IN A VISUA / interactive map view

ransparent Metrics

- Regularly share metrics on:

- Total tokens burned from sell tax buy-backs.

- Revenue-sharing payouts and staking rewards.

- Portfolio growth and fund performance.

Increasing Investor and Token-Holder Value Long-term

Staking of $DEXI tokens reducing circulating supply

Revenue Share directly connected to fund and portfolios profits.

Personal portfolio mangement

Access to Autonomous AI Agents

Access to Trading Algorithms and Data

Developer Access to Infrastructure and Data Centres / Aggregators

ACCESS NFT’s

Frequent Buybacks + Burns decreasing Total Supply and Increasing Scarcity

Dividends Distributed to Staked Tokens as a percentage of funds annual performance

1. Growth Phase vs. Maturity Phase

- In the early stages, you need liquidity and capital to grow the fund and attract investors.

- As the fund matures, shifting focus to scarcity (deflation) aligns with long-term investor interests.

2. Dual Benefits for Investors

- Early investors benefit from the fund’s growth as the 1% tax is reinvested into the portfolio.

- Later investors enjoy token price appreciation driven by the deflationary burn mechanism.

Dexifund Vision for DEF-AI Future

Protocol Fees:

Introduce protocol-level fees for external users if the fund eventually evolves into a broader DeFi ecosystem (e.g., providing managed portfolios for other users).

Treasury Investments:

- Actively manage the treasury funds (e.g., token reserves or buy/sell taxes) to generate additional returns, such as deploying idle capital into low-risk DeFi strategies.

Performance Fee (Optional):

- Charge a performance fee (e.g., 10-20%) on profits exceeding a certain benchmark.

- Example: 20% of profits beyond a 10% annual return for investors.

- Incentive: Aligns team performance with investor returns.

Financial Disclaimer

Dexifund and associated products do not offer any promose or guarantee of profits, we ask that every investor, speculator and member of the public does their own due dilligence before investing in our project. Non of what is mentioned in this document should be seen as financial advise and we accept no liability for loss of funds or income through investing in our token or any of our products.

Investor Relations

Speculation on Token Price:

- Investors benefit from the speculative growth of your token, which is tied to the performance of the fund.

- Token Price Growth Drivers:

- Fund Performance: As the fund’s AUM grows (through smart trading, yield farming, staking), the perceived value of the token increases.

- Buy-Backs: 1% sell tax creates constant demand for the token on the open market, potentially boosting its price.

- Burn Mechanism: Over time, buy-backs paired with burns reduce supply, increasing scarcity and supporting long-term price appreciation.

Exposure to Actively Traded DeFi Portfolio:

- Access to Expertise: The fund is actively managed by skilled traders and portfolio managers who select high-growth opportunities across DeFi and crypto markets.

- Diversification: Investors gain exposure to a professionally curated portfolio, mitigating risk compared to investing in single projects or tokens.

- Yield and Staking Opportunities: The portfolio may include yield-generating assets, ensuring consistent fund growth even in volatile markets.

Stable and Sustainable Portfolio:

- The 1% buy tax for operational costs ensures that infrastructure, security, and management are sustainably funded.

- Active portfolio management provides stability by balancing riskier high-growth DeFi projects with more stable assets (e.g., ETH, stablecoins, or blue-chip crypto).

Future Revenue Sharing / Dividends:

- Dividends from Fund Profits:

- Down the line, investors can receive periodic dividends or revenue sharing based on fund profits.

- This creates a tangible return on investment beyond token price speculation.

- Example Structure:

- Dividends Paid in ETH or USDT: Distribute profits directly to token holders proportional to their stake.

- Staking to Earn Dividends: Investors lock tokens to receive a share of profits, incentivizing long-term holding and reducing market supply.

- Dividends from Fund Profits:

Access to DeFi Strategies and Tools:

- By holding the token, investors gain exposure to yield farming, staking, and liquidity provision strategies that are often complex or inaccessible to retail investors.

- The fund handles the operational complexities, providing investors with passive exposure to advanced DeFi opportunities.

Transparency and Community Governance:

- Investors could participate in the governance of the fund:

- Voting Rights: Token holders can vote on portfolio adjustments, strategies, or tokenomics changes, giving them a sense of ownership.

- Transparency in fund performance, buy-back/burn metrics, and dividend distribution builds trust.

- Investors could participate in the governance of the fund:

“A Phased Approach to Value Creation”

- In the early growth phase, our tokenomics focus on creating scarcity and stability through buybacks and burns, ensuring early investors benefit from price appreciation.

- As the ecosystem matures, we transition to a revenue-sharing model, rewarding token holders with a share of fund profits while maintaining moderate deflation through partial burns.

- This strategy ensures that our token remains valuable, liquid, and attractive to both early adopters and long-term investors, creating a sustainable ecosystem where ‘a rising tide lifts all ships.’

Dexifund Def-AI Project Incubator Plan

Purpose:

- To support and nurture new AI/DeFi projects by offering grants or vested token incentives.

- To build relationships with up-and-coming projects, potentially securing early-stage equity or token allocations in exchange for support.

- To position Dexifund as a thought leader in DeFi-AI, creating brand value and community goodwill.

Token Allocation

- Yearly Unlock: 10,000,000 $DEXI tokens unlocked each year for Dexifund Def-AI Project Incubator.

- Use of Tokens:

- Grants: Projects can receive $DEXI tokens as direct funding.

- Staking/Vesting Mechanism: Ensure the tokens cannot be sold immediately to avoid dumping and market disruptions.

- Revenue Share Incentive: Encourage projects to stake their tokens to earn revenue share from Dexifund operations, aligning their growth with Dexifund’s success.

Implementation Details

Vesting Mechanism:

- Lock Period: Tokens awarded to projects are locked for 1-2 years.

- Gradual Unlock: Use a linear unlock schedule, where tokens become accessible in monthly increments over time.

- Smart Contract Implementation: Automatically enforce vesting using a vesting contract that projects agree to upon acceptance of the grant.

Grant Options:

- Pure Token Grant: Provide tokens outright, but enforce vesting schedules.

- Hybrid Grant: Combine tokens with cash grants derived from treasury reserves to provide immediate liquidity for projects.

- Milestone-Based Grant: Projects receive tokens in tranches as they achieve pre-defined development milestones.

Incubator Equity Option:

- Offer funding in exchange for a stake in the incubated projects (either token allocations or equity).

- Negotiate discounted token prices or private presale allocations for projects with strong growth potential.

Incubator Evaluation Criteria:

- Only support innovative and scalable projects that align with the vision of DeFi and AI integration.

- Evaluate project whitepapers, roadmaps, team experience, and market fit rigorously before allocating funds.

Mechanisms to Prevent Token Dumping

Staking Requirement for Grants:

- Require funded projects to stake a percentage of their awarded tokens into the Dexifund staking platform.

- Offer additional yield or governance benefits to incentivize holding.

Revenue Sharing Model:

- Allocate 25% of incubator profits back to Dexifund treasury and/or token holders.

- Build long-term value by ensuring incubated projects contribute back to the ecosystem.

Clawback Clause:

- Include a clawback mechanism in grant agreements that allows Dexifund to reclaim tokens if the project abandons its roadmap or breaches agreed terms.

Benefits of the Dexifund Def-AI Incubator

Attracting Talent and Innovation:

- By creating a war chest for grants, Dexifund can position itself as the go-to platform for DeFi and AI innovation.

- Building strong partnerships with successful projects can lead to exponential returns on incubator investments.

Value Accretion for $DEXI:

- As incubated projects grow, Dexifund benefits from equity positions, token allocations, or partnerships.

- The $DEXI token gains utility as the incubator’s grant currency, driving demand.

Deflationary Impact:

- If projects are incentivized to stake their tokens or participate in the revenue-sharing program, the circulating supply of $DEXI remains controlled, supporting price stability and growth.

Community and Ecosystem Growth:

- Dexifund can attract developers, innovators, and investors to its ecosystem by becoming a hub for DeFi-AI development.

- This positions the fund for long-term relevance and scalability.

Potential Challenges

- Ensuring Accountability:

- Vetting projects and ensuring they deliver on their promises will require a dedicated evaluation team.

- Smart Contract Risk:

- Building robust vesting and staking contracts is critical to avoid security vulnerabilities.

Example Token Flow for the Incubator

- Yearly Unlock: 10M tokens per year (50M over 5 years).

- Allocation:

- Grants: 70% (e.g., 7M tokens/year).

- Vesting Reserves: 20% (e.g., 2M tokens/year for delayed distribution).

- Treasury Reinvestment: 10% (e.g., 1M tokens/year retained for operational or strategic reinvestment).

*Financial Disclaimer: NFA , Read our financial transparency report, read our mission statement,

9. Liquidity Management

- Liquidity Provision:

- Describe how liquidity pools are maintained.

- Slippage Control:

- Explain measures to reduce slippage during token trading.

- Exchange Listings:

- List DEXs and CEXs where $DEXI will be listed.

13. Frequently Asked Questions (FAQs)

- Address common queries such as:

- What is $DEXI used for?

- How does the buyback-and-burn work?

- What are the risks of investing in $DEXI?

- USE AN ACCORDION DROPDOWN HERE

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Erat enim res aperta. Ne discipulum abducam, times. Primum quid tu dicis breve? An haec ab eo non dicuntur?

Aliter homines, aliter philosophos loqui putas oportere? Sin aliud quid voles, postea. Mihi enim satis est, ipsis non satis. Negat enim summo bono afferre incrementum diem. Quod ea non occurrentia fingunt, vincunt Aristonem.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

VIDEO GUIDES TO INCLUDE

1. Tokenomics Overview

- Content: A high-level explainer video outlining Dexifund’s tokenomics, covering key points like total supply, allocation, buybacks, burns, and tax structure.

- Duration: 2-3 minutes.

- Purpose: Quickly introduce viewers to the tokenomics model and its benefits for investors.

- Style: Animated explainer or voiceover with infographics.

2. How Buybacks and Burns Work

- Content: Explain how the buyback-and-burn mechanism reduces circulating supply, increases scarcity, and boosts token value over time.

- Duration: 2 minutes.

- Purpose: Help viewers understand how this deflationary mechanism benefits them as token holders.

- Style: Animated charts showing real-time simulations of supply reduction and price impact.

3. Staking and Revenue Sharing

- Content: Showcase how token holders can stake $DEXI to earn rewards or participate in revenue sharing. Include examples of potential returns.

- Duration: 3 minutes.

- Purpose: Highlight the passive income opportunities for long-term holders.

- Style: Voiceover with staking platform walkthrough or ROI simulations.

4. Simulating Dexifund Token Growth

- Content: Present a visual simulation of how $DEXI might grow over five years under different market conditions (e.g., bull vs. bear markets).

- Duration: 3-4 minutes.

- Purpose: Build confidence in the token’s growth potential.

- Style: Interactive graph demonstrations with voiceover.

5. Liquidity and Exchange Listings

- Content: Explain how Dexifund ensures liquidity in DEXs and CEXs to facilitate smooth trading and prevent slippage.

- Duration: 2 minutes.

- Purpose: Showcase liquidity provision and highlight future exchange listings.

- Style: Visual walkthrough of liquidity pools and trading examples.

6. Dexifund Def-AI Incubator

- Content: Highlight how the incubator will fund innovative AI/DeFi projects, provide grants, and support emerging teams.

- Duration: 3 minutes.

- Purpose: Attract innovators and emphasize Dexifund’s role in shaping the DeFi-AI space.

- Style: Testimonials or use cases of funded projects (real or hypothetical).

7. Governance and Voting Mechanisms

- Content: Explain how token holders can participate in governance, vote on proposals, and influence project decisions.

- Duration: 2 minutes.

- Purpose: Highlight the decentralized nature of Dexifund and the benefits of active participation.

- Style: Animated walkthrough of governance portals.

8. How to Participate in the Presale

- Content: Step-by-step instructions on how to participate in the $DEXI token presale. Cover wallet setup, contributions, and claiming tokens.

- Duration: 3 minutes.

- Purpose: Simplify the process for potential investors.

- Style: Tutorial-style video with screen recording.

9. Risks and Mitigation

- Content: Discuss potential risks like market volatility, liquidity issues, and regulatory challenges, and explain how Dexifund addresses them.

- Duration: 2 minutes.

- Purpose: Build transparency and trust.

- Style: Informative video with reassuring tone.

10. Frequently Asked Questions

- Content: Answer FAQs like:

- What is $DEXI used for?

- How do buybacks and burns impact the price?

- How does staking work?

- Duration: 3 minutes.

- Purpose: Address common concerns in a quick, digestible format.

- Style: Conversational or animated with a Q&A format.

11. Roadmap and Future Plans

- Content: Walk viewers through Dexifund’s roadmap, covering milestones like token launch, staking, incubator projects, and new partnerships.

- Duration: 3 minutes.

- Purpose: Show long-term vision and build excitement.

- Style: Timeline animation with key milestones highlighted.

12. Testimonials or Case Studies

- Content: Include interviews or stories (real or simulated) of early adopters, funded projects, or investors who benefited from Dexifund.

- Duration: 3-4 minutes.

- Purpose: Add a personal and relatable touch to the project.

- Style: Interview format or project case study with visuals.

13. Behind the Scenes

- Content: Show the team behind Dexifund, their expertise, and how they’re building the project.

- Duration: 2-3 minutes.

- Purpose: Build trust by introducing the people involved.

- Style: Team video with office/lab walkthrough.

14. Educational Content

- Content: Create general videos on DeFi, AI, or blockchain technology, positioning Dexifund as an authority in the space.

- Duration: 5-6 minutes.

- Purpose: Attract broader audiences and drive traffic to your site.

- Style: Informational or tutorial-based.

15. Tokenomics Deep Dive

- Content: Detailed breakdown of all tokenomics aspects, including allocation, taxes, buybacks, staking, and projections.

- Duration: 5 minutes.

- Purpose: Provide an in-depth understanding for serious investors.

- Style: Presentation-style video with graphs, charts, and animations.

- Buyback and burn mechanisms have been implemented across a range of crypto projects at different

layers of the Web3 stack. Some of the most prominent examples have been in the tokens associated

with centralised exchanges:

● FTX undertakes a buyback and burn of their native token FTT on a weekly basis. They

buyback and burn approximately 33% of fee revenue through the exchange. FTX plans to

undertake this process until 50% of total token supply has been burnt.

● Binance undertakes a buyback and burn of their native token BNB on a quarterly basis. The

size of the buyback and burn is based on quarterly trading volume on the exchange, and the

exchange also plans to burn down to 50% of total token supply.

● Bitfinex undertakes a buyback and burn of their native LEO token based on 27% of revenues.

They do not have a limit on the total buyback and burn amount, and plan to buyback and

burn until there are “no tokens in commercial circulation” = INTEGRATE THIS IDEA BUYBACKS AND BURNS UNTIL 50% OF THE SUPPLY IS BURNT)